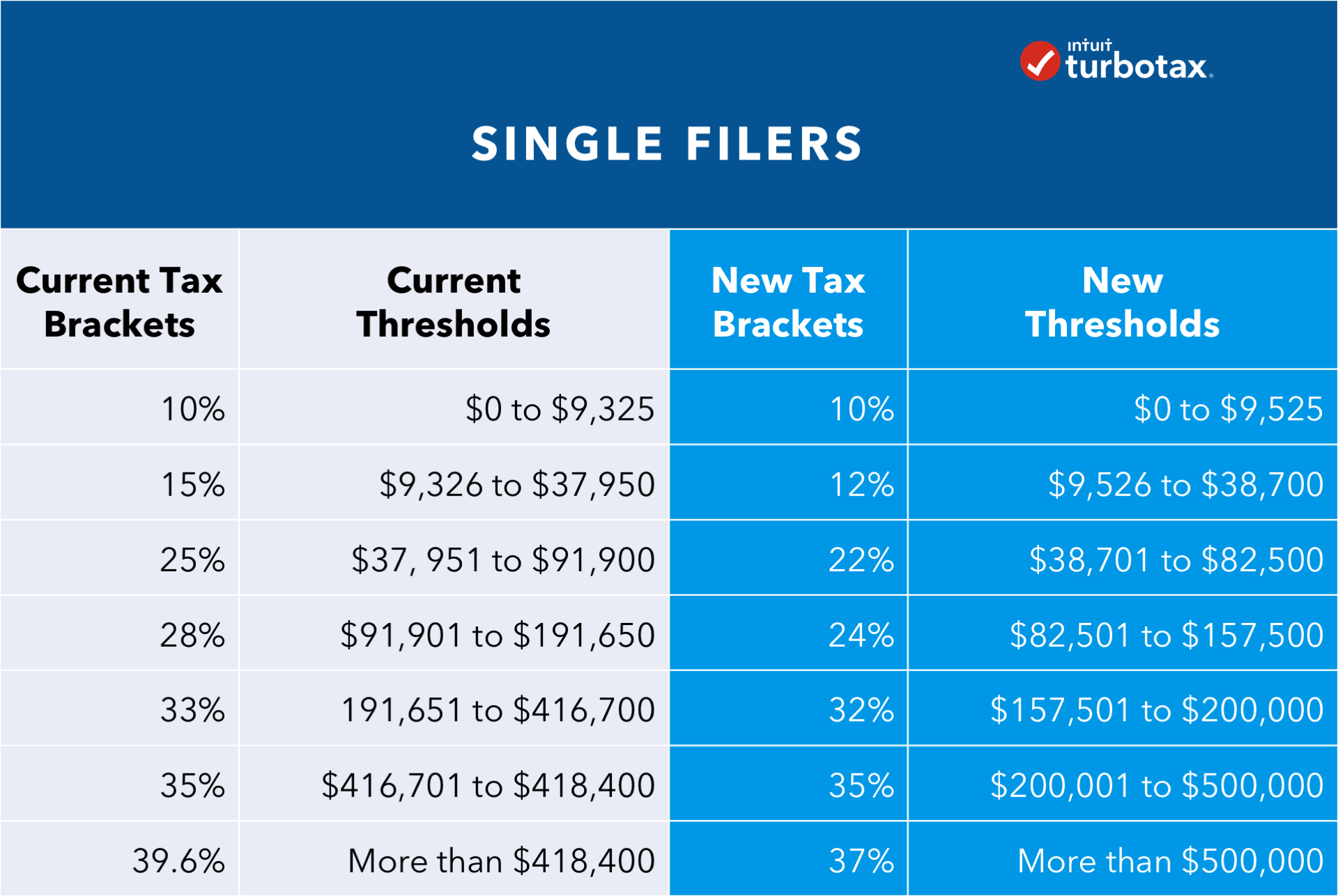

Tax Brackets 2025 Single Filers. Tax brackets for people filing as single individuals for 2025. Let’s say for the 2025 tax year (filing in 2025), you earned a taxable income of $90,000, and you filed as single.

For example, an unmarried filer with taxable income of $100,000 has a top federal tax rate of 22% for the 2025 tax year, down from 24% in 2025. The standard deduction for single taxpayers and married individuals filing separately will be $14,600, up $750 over 2025.

Tax Brackets 2025 Single Filer Lenna Nicolle, Tax brackets for people filing as single individuals for 2025.

Tax Brackets 2025 Single Filers Xenia Karoline, Find the current tax rates for other filing statuses.

2025 Tax Bracket Single Filer Ethyl Janessa, 10% for single filers with incomes of $11,600 or less and for married couples filing a joint tax return with incomes of $23,200.

Us Tax Brackets 2025 Single Dayle Erminie, See current federal tax brackets and rates based on your income and.

Tax Brackets 2025 For Single Person Drusy Sharon, For example, an unmarried filer with taxable income of $100,000 has a top federal tax rate of 22% for the 2025 tax year, down from 24% in 2025.

2025 Tax Brackets Single Filer Laney Rebeka, Find the current tax rates for other filing statuses.

Tax Bracket 2025 Married Filing Jointly Vs Single Gael Pattie, Based on the tax brackets, you’ll fall under the third tax.

2025 Tax Brackets Chart Pdf Dacy Jessamine, The standard deduction is $15,000 for single filers and $30,000 if you’re married filing jointly in tax year 2025.

2025 Tax Brackets Single Filing Min Laurel, For single filers, the standard deduction for 2025 will be $14,600, up from $13,850 this year.